5.2 LSTM and GRU#

!wget -nc --no-cache -O init.py -q https://raw.githubusercontent.com/rramosp/2021.deeplearning/main/content/init.py

import init; init.init(force_download=False);

%matplotlib inline

U5.02 - Long Short Term Memory RNN#

The main drawback of conventional RNNs is its inability to learn long term dependency, or even the capacity of capturing long and short dependences at the same time.

Remenber that in a RNN:

and,

and,

Therefore, during the training phase of one time series, the matrix \(\bf{V}\), which contains the weights of the feedback loop, mulplies by itself \((\tau-1)\) times. Thus, if its values are close to zero, the weights end up vanishing. On the contrary, if the weights of \(\bf{V}\) are to large, they end up diverging (in case of no regularization method be included). This fact makes conventional RNNs very unstable.

They are also very sensitive to vanishing gradients phenomena, but it can be overcome by using Relu or LeakyRelu activation functions.

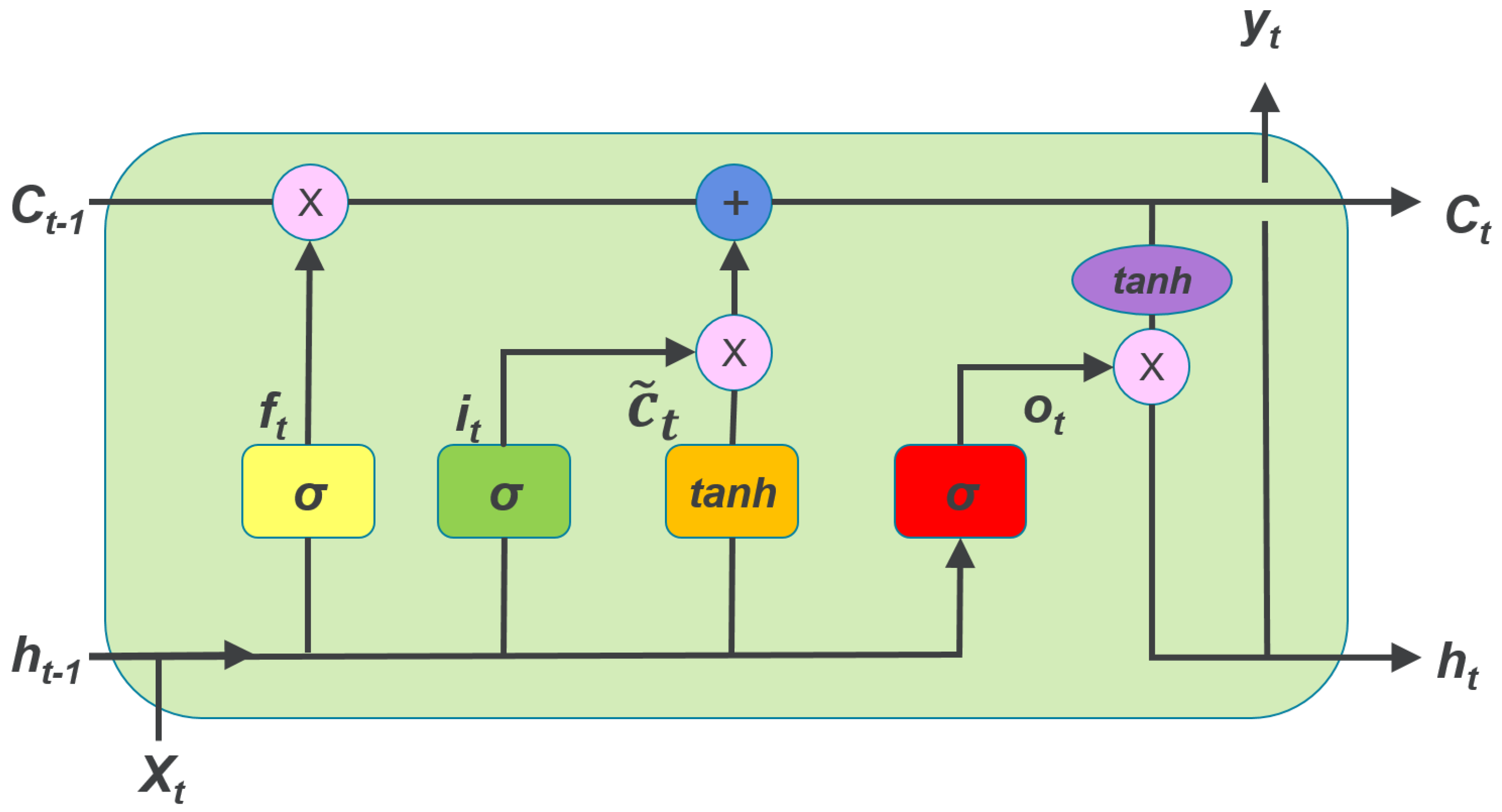

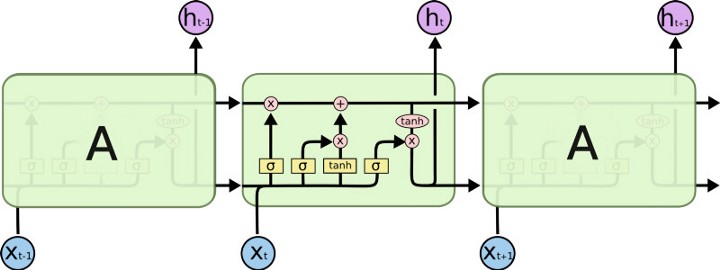

LSTMs are a type of RNNs proposed to takle the former problems. They were introduced in 1997 and are based on different type of basic unit called cell.

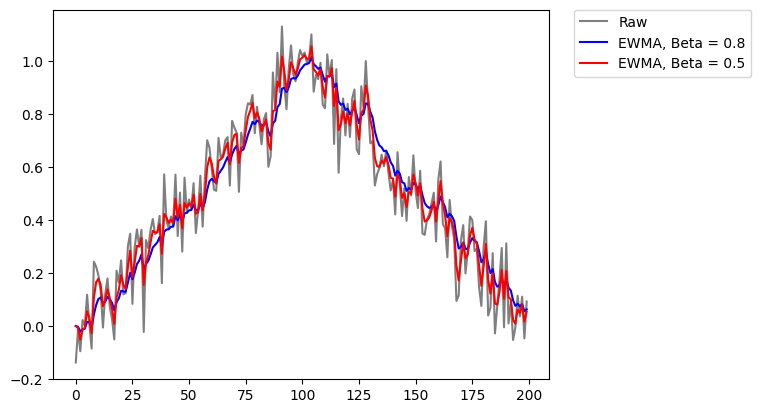

The cells use the principle of cumulative average called Exponential Weighted Moving Average (EWMA) originally proposed for a type of units called leaky units. EWMA takes into account more or less information from the past based on a \(\beta\) paratemer. The rule is given by: \(\mu^{(t)} \leftarrow \beta \mu^{(t-1)} + (1 - \beta)\upsilon^{(t)}\).

import numpy as np

import matplotlib.pyplot as plt

# make a hat function, and add noise

x = np.linspace(0,1,100)

x = np.hstack((x,x[::-1]))

x += np.random.normal( loc=0, scale=0.1, size=200 )

plt.plot( x, 'k', alpha=0.5, label='Raw' )

Beta1 = 0.8

Beta2 = 0.5

x1 = np.zeros(200)

x2 = np.copy(x1)

for i in range(1,200):

x1[i] = Beta1*x1[i-1] + (1-Beta1)*x[i]

x2[i] = Beta2*x2[i-1] + (1-Beta2)*x[i]

# regular EWMA, with bias against trend

plt.plot( x1, 'b', label='EWMA, Beta = 0.8' )

# "corrected" (?) EWMA

plt.plot( x2, 'r', label='EWMA, Beta = 0.5' )

plt.legend(bbox_to_anchor=(1.05, 1), loc=2, borderaxespad=0.)

plt.show()

#savefig( 'ewma_correction.png', fmt='png', dpi=100 )

The LSTM network uses the same principle the level of memory or time dependence, but instead of one controling parameter, it define gates adjusted during the training phase.

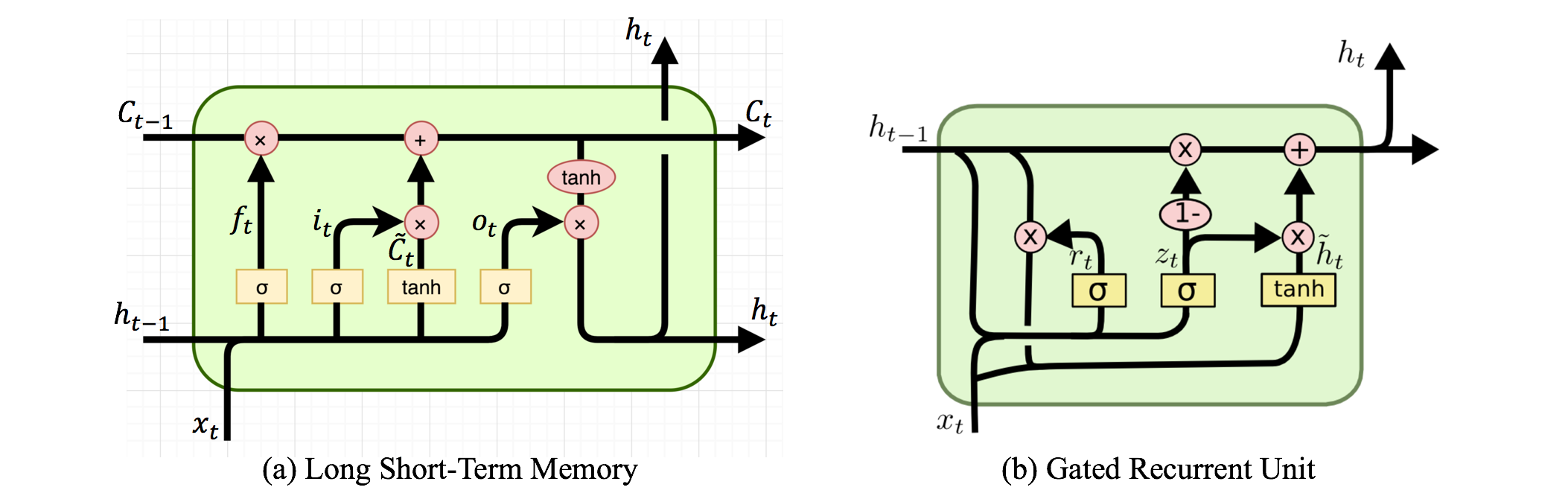

Every cell LSTM contains three gates (the three \(\sigma's\) in the former graph):

The first step in the LSTM is to decide what information is going to be throwed away from the cell state. This decision is made by a sigmoid layer called the forget gate layer. It looks at \(h_{t−1}\) and \(x_t\), and outputs a number between 0 and 1 for each number in the cell state \(C_{t−1}\). A 1 represents “completely keep this” while a 0 represents “completely get rid of this.”

The next step is to decide what new information is going to be stored in the cell state. This has two parts. First, a sigmoid layer called the input gate layer decides which values will be updated. Next, a tanh layer creates a vector of new candidate values, \(\tilde{C}_t\), that could be added to the state.

Finally, the cell decides what is going to output. This output will be based on the cell state, but will be a filtered version. First, it runs a output gate layer which decides what part of the cell state is going to output. Then, the cell state is passed through a tanh function (to push the values to be between −1 and 1) and multiplied it by the output of the gate.

Based on these gates, the state of the cell and output of the cell can be calculated as:

# Importing the libraries

import numpy as np

import matplotlib.pyplot as plt

plt.style.use('fivethirtyeight')

import pandas as pd

from sklearn.preprocessing import MinMaxScaler

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense, LSTM, Dropout, GRU, SimpleRNN, Input

import math

from sklearn.metrics import mean_squared_error

# First, we get the data

dataset = pd.read_csv('local/data/KO_2006-01-01_to_2018-01-01.csv', index_col='Date', parse_dates=['Date'])

dataset.head()

| Open | High | Low | Close | Volume | Name | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2006-01-03 | 20.40 | 20.50 | 20.18 | 20.45 | 13640800 | KO |

| 2006-01-04 | 20.50 | 20.54 | 20.33 | 20.41 | 19993200 | KO |

| 2006-01-05 | 20.36 | 20.56 | 20.29 | 20.51 | 16613400 | KO |

| 2006-01-06 | 20.53 | 20.78 | 20.43 | 20.70 | 17122800 | KO |

| 2006-01-09 | 20.74 | 20.84 | 20.62 | 20.80 | 13819800 | KO |

# Checking for missing values

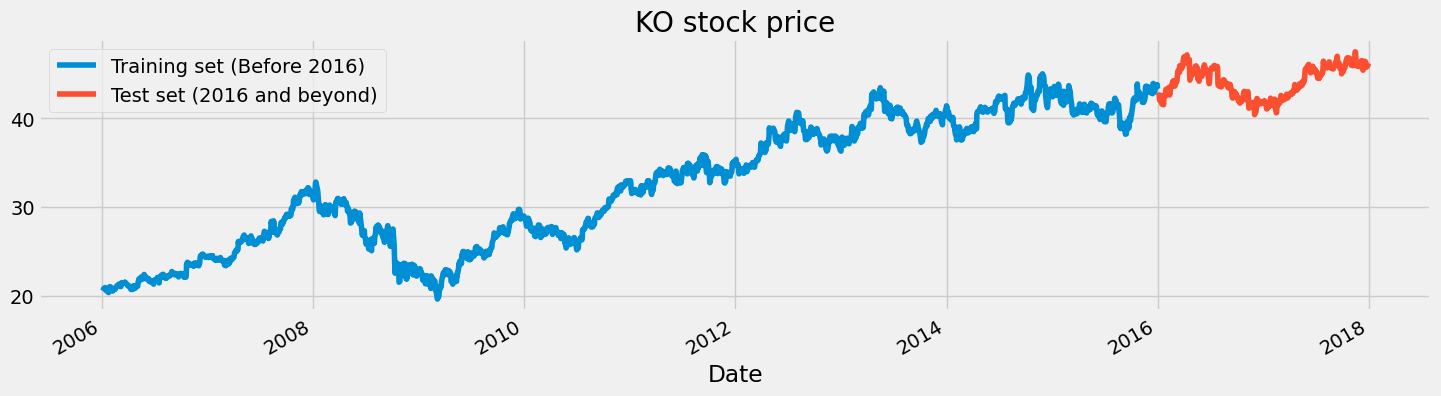

training_set = dataset[:'2015'].iloc[:,1:2].values

test_set = dataset['2016':].iloc[:,1:2].values

test_set[np.isnan(test_set)] = dataset['High'].max()

# We have chosen 'High' attribute for prices. Let's see what it looks like

dataset["High"][:'2015'].plot(figsize=(16,4),legend=True)

dataset["High"]['2016':].plot(figsize=(16,4),legend=True)

plt.legend(['Training set (Before 2016)','Test set (2016 and beyond)'])

plt.title('KO stock price')

plt.show()

# Scaling the training set

sc = MinMaxScaler(feature_range=(0,1))

training_set_scaled = sc.fit_transform(training_set)

from local.lib.DataPreparationRNN import create_dataset

look_back = 10

X_train, y_train = create_dataset(training_set_scaled, look_back)

print(X_train.shape)

print(y_train.shape)

(2507, 10)

(2507,)

# The RNN architecture

model = Sequential()

model.add(Input(shape=(X_train.shape[1],1)))

# First RNN layer with Dropout regularisation

model.add(SimpleRNN(units=50))

model.add(Dropout(0.2))

# The output layer

model.add(Dense(units=1))

model.summary()

Model: "sequential"

┏━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━┓ ┃ Layer (type) ┃ Output Shape ┃ Param # ┃ ┡━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━┩ │ simple_rnn (SimpleRNN) │ (None, 50) │ 2,600 │ ├─────────────────────────────────┼────────────────────────┼───────────────┤ │ dropout (Dropout) │ (None, 50) │ 0 │ ├─────────────────────────────────┼────────────────────────┼───────────────┤ │ dense (Dense) │ (None, 1) │ 51 │ └─────────────────────────────────┴────────────────────────┴───────────────┘

Total params: 2,651 (10.36 KB)

Trainable params: 2,651 (10.36 KB)

Non-trainable params: 0 (0.00 B)

Let’s remember what a RNN can do:

# Compiling the RNN

model.compile(optimizer='adam',loss='mean_squared_error')

# Fitting to the training set

model.fit(X_train.reshape(X_train.shape[0],look_back,1),y_train,epochs=50,batch_size=32)

Epoch 1/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 657us/step - loss: 0.0611

Epoch 2/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 562us/step - loss: 0.0064

Epoch 3/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 563us/step - loss: 0.0046

Epoch 4/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 563us/step - loss: 0.0040

Epoch 5/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 570us/step - loss: 0.0035

Epoch 6/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 563us/step - loss: 0.0030

Epoch 7/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 559us/step - loss: 0.0029

Epoch 8/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 561us/step - loss: 0.0027

Epoch 9/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 559us/step - loss: 0.0026

Epoch 10/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 558us/step - loss: 0.0026

Epoch 11/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 560us/step - loss: 0.0025

Epoch 12/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 559us/step - loss: 0.0021

Epoch 13/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 562us/step - loss: 0.0020

Epoch 14/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 559us/step - loss: 0.0019

Epoch 15/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 563us/step - loss: 0.0022

Epoch 16/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 566us/step - loss: 0.0019

Epoch 17/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 560us/step - loss: 0.0022

Epoch 18/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 561us/step - loss: 0.0019

Epoch 19/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 588us/step - loss: 0.0020

Epoch 20/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 584us/step - loss: 0.0019

Epoch 21/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 577us/step - loss: 0.0016

Epoch 22/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 582us/step - loss: 0.0019

Epoch 23/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 572us/step - loss: 0.0016

Epoch 24/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 584us/step - loss: 0.0017

Epoch 25/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 597us/step - loss: 0.0016

Epoch 26/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 589us/step - loss: 0.0015

Epoch 27/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 579us/step - loss: 0.0016

Epoch 28/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 883us/step - loss: 0.0016

Epoch 29/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 593us/step - loss: 0.0014

Epoch 30/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 616us/step - loss: 0.0013

Epoch 31/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 614us/step - loss: 0.0013

Epoch 32/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 649us/step - loss: 0.0012

Epoch 33/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 641us/step - loss: 0.0012

Epoch 34/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 617us/step - loss: 0.0012

Epoch 35/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 632us/step - loss: 0.0011

Epoch 36/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 635us/step - loss: 0.0011

Epoch 37/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 635us/step - loss: 9.8205e-04

Epoch 38/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 616us/step - loss: 0.0012

Epoch 39/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 612us/step - loss: 9.8427e-04

Epoch 40/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 612us/step - loss: 0.0010

Epoch 41/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 622us/step - loss: 0.0010

Epoch 42/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 622us/step - loss: 9.7476e-04

Epoch 43/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 618us/step - loss: 9.1240e-04

Epoch 44/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 633us/step - loss: 0.0011

Epoch 45/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 645us/step - loss: 8.2203e-04

Epoch 46/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 648us/step - loss: 9.9008e-04

Epoch 47/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 627us/step - loss: 8.7365e-04

Epoch 48/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 955us/step - loss: 9.1499e-04

Epoch 49/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 627us/step - loss: 9.0956e-04

Epoch 50/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 640us/step - loss: 8.3333e-04

<keras.src.callbacks.history.History at 0x32b78d6a0>

dataset_total = pd.concat((dataset["High"][:'2016'],dataset["High"]['2017':]),axis=0)

inputs = dataset_total[len(dataset_total)-len(test_set) - look_back:].values

inputs[np.isnan(inputs)] = dataset['High'].max()

inputs = inputs.reshape(-1,1)

inputs = sc.transform(inputs)

inputs.shape

(513, 1)

# Preparing X_test and predicting the prices

X_test = []

for i in range(look_back,inputs.shape[0]):

X_test.append(inputs[i-look_back:i,0])

X_test = np.array(X_test)

X_test = np.reshape(X_test, (X_test.shape[0],X_test.shape[1],1))

predicted_stock_price = model.predict(X_test)

predicted_stock_price = sc.inverse_transform(predicted_stock_price)

16/16 ━━━━━━━━━━━━━━━━━━━━ 0s 4ms/step

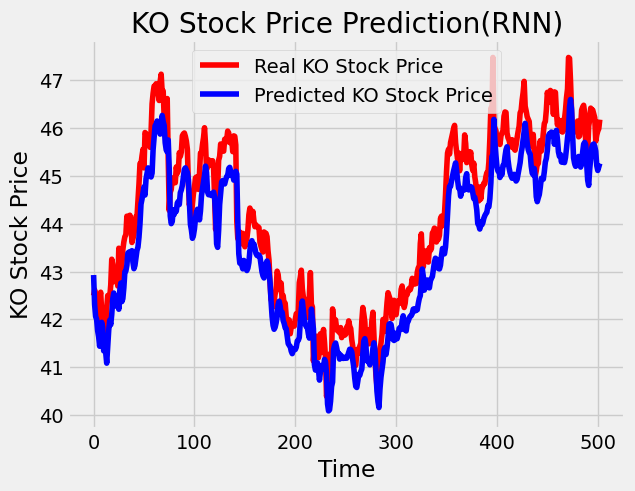

# Visualizing the results

plt.plot(test_set, color='red',label='Real KO Stock Price')

plt.plot(predicted_stock_price, color='blue',label='Predicted KO Stock Price')

plt.title('KO Stock Price Prediction(RNN)')

plt.xlabel('Time')

plt.ylabel('KO Stock Price')

plt.legend()

plt.show()

# Evaluating our model

import math

from sklearn.metrics import mean_squared_error

rmse = math.sqrt(mean_squared_error(test_set, predicted_stock_price))

print("The root mean squared error is {}.".format(rmse))

The root mean squared error is 0.7130857635072282.

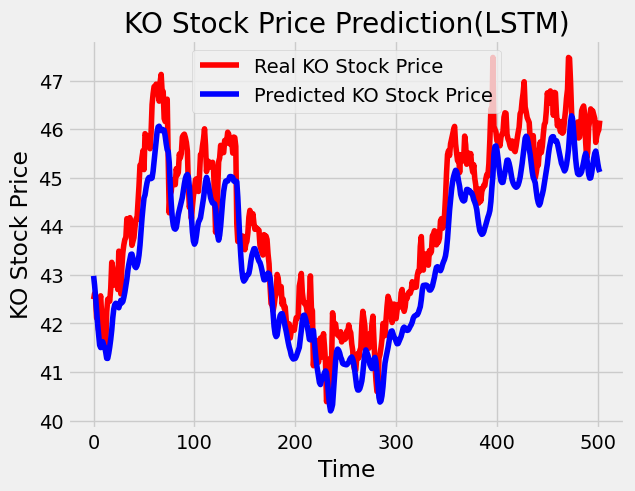

Now using a LSTM:

# The LSTM architecture

regressor = Sequential()

regressor.add(Input(shape=(X_train.shape[1],1)))

# First LSTM layer with Dropout regularisation

regressor.add(LSTM(units=50))

regressor.add(Dropout(0.3))

regressor.add(Dense(units=1))

regressor.summary()

Model: "sequential_1"

┏━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━┓ ┃ Layer (type) ┃ Output Shape ┃ Param # ┃ ┡━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━┩ │ lstm (LSTM) │ (None, 50) │ 10,400 │ ├─────────────────────────────────┼────────────────────────┼───────────────┤ │ dropout_1 (Dropout) │ (None, 50) │ 0 │ ├─────────────────────────────────┼────────────────────────┼───────────────┤ │ dense_1 (Dense) │ (None, 1) │ 51 │ └─────────────────────────────────┴────────────────────────┴───────────────┘

Total params: 10,451 (40.82 KB)

Trainable params: 10,451 (40.82 KB)

Non-trainable params: 0 (0.00 B)

# Compiling the RNN

regressor.compile(optimizer='adam',loss='mean_squared_error')

# Fitting to the training set

regressor.fit(X_train.reshape(X_train.shape[0],look_back,1),y_train,epochs=50,batch_size=32)

Epoch 1/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.1272

Epoch 2/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 990us/step - loss: 0.0066

Epoch 3/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0048

Epoch 4/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0043

Epoch 5/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0040

Epoch 6/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 991us/step - loss: 0.0038

Epoch 7/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 992us/step - loss: 0.0035

Epoch 8/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 985us/step - loss: 0.0035

Epoch 9/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 984us/step - loss: 0.0037

Epoch 10/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 981us/step - loss: 0.0033

Epoch 11/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 981us/step - loss: 0.0028

Epoch 12/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0032

Epoch 13/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0029

Epoch 14/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0026

Epoch 15/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 986us/step - loss: 0.0029

Epoch 16/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 990us/step - loss: 0.0027

Epoch 17/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 985us/step - loss: 0.0026

Epoch 18/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 985us/step - loss: 0.0027

Epoch 19/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 978us/step - loss: 0.0025

Epoch 20/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 982us/step - loss: 0.0026

Epoch 21/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 981us/step - loss: 0.0024

Epoch 22/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 982us/step - loss: 0.0028

Epoch 23/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 985us/step - loss: 0.0023

Epoch 24/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 983us/step - loss: 0.0023

Epoch 25/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 986us/step - loss: 0.0021

Epoch 26/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 983us/step - loss: 0.0024

Epoch 27/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 984us/step - loss: 0.0020

Epoch 28/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 983us/step - loss: 0.0021

Epoch 29/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 992us/step - loss: 0.0018

Epoch 30/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0020

Epoch 31/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0019

Epoch 32/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 991us/step - loss: 0.0019

Epoch 33/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0017

Epoch 34/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0018

Epoch 35/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 993us/step - loss: 0.0017

Epoch 36/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 990us/step - loss: 0.0017

Epoch 37/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 987us/step - loss: 0.0015

Epoch 38/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 988us/step - loss: 0.0016

Epoch 39/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 989us/step - loss: 0.0015

Epoch 40/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 41/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 42/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0016

Epoch 43/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0015

Epoch 44/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 45/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 46/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 47/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 48/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 49/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 50/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0012

<keras.src.callbacks.history.History at 0x32ce9a190>

predicted_stock_price = regressor.predict(X_test)

predicted_stock_price = sc.inverse_transform(predicted_stock_price)

16/16 ━━━━━━━━━━━━━━━━━━━━ 0s 3ms/step

# Visualizing the results

plt.plot(test_set, color='red',label='Real KO Stock Price')

plt.plot(predicted_stock_price, color='blue',label='Predicted KO Stock Price')

plt.title('KO Stock Price Prediction(LSTM)')

plt.xlabel('Time')

plt.ylabel('KO Stock Price')

plt.legend()

plt.show()

# Evaluating our model

rmse = math.sqrt(mean_squared_error(test_set, predicted_stock_price))

print("The root mean squared error is {}.".format(rmse))

The root mean squared error is 0.8338981916716676.

Gated Recurrent Units#

The GRU unit does not have to use a memory unit to control the flow of information like the LSTM unit. It can directly makes use of the all hidden states without any control. GRUs have fewer parameters and thus may train a bit faster or need less data to generalize. But, with large data, the LSTMs with higher expressiveness may lead to better results. Source

Here \(r\) is a reset gate, and \(z\) is an update gate. Intuitively, the reset gate determines how to combine the new input with the previous memory, and the update gate defines how much of the previous memory to keep around. If set the reset to all 1’s and update gate to all 0’s, it will arrive at the vanilla RNN model.

# The GRU architecture

regressor2 = Sequential()

regressor2.add(Input(shape=(X_train.shape[1],1)))

# First GRU layer with Dropout regularisation

regressor2.add(GRU(units=50))

regressor2.add(Dropout(0.3))

# The output layer

regressor2.add(Dense(units=1))

regressor2.summary()

Model: "sequential_2"

┏━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━━━━━━━━━━┳━━━━━━━━━━━━━━━┓ ┃ Layer (type) ┃ Output Shape ┃ Param # ┃ ┡━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━━━━━━━━━━╇━━━━━━━━━━━━━━━┩ │ gru (GRU) │ (None, 50) │ 7,950 │ ├─────────────────────────────────┼────────────────────────┼───────────────┤ │ dropout_2 (Dropout) │ (None, 50) │ 0 │ ├─────────────────────────────────┼────────────────────────┼───────────────┤ │ dense_2 (Dense) │ (None, 1) │ 51 │ └─────────────────────────────────┴────────────────────────┴───────────────┘

Total params: 8,001 (31.25 KB)

Trainable params: 8,001 (31.25 KB)

Non-trainable params: 0 (0.00 B)

# Compiling the RNN

regressor2.compile(optimizer='adam',loss='mean_squared_error')

# Fitting to the training set

regressor2.fit(X_train.reshape(X_train.shape[0],look_back,1),y_train,epochs=50,batch_size=32)

Epoch 1/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 1s 1ms/step - loss: 0.0943

Epoch 2/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0055

Epoch 3/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0048

Epoch 4/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0039

Epoch 5/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0036

Epoch 6/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0032

Epoch 7/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0031

Epoch 8/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0031

Epoch 9/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0031

Epoch 10/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0030

Epoch 11/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0028

Epoch 12/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0031

Epoch 13/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0027

Epoch 14/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0028

Epoch 15/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0022

Epoch 16/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0023

Epoch 17/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0024

Epoch 18/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0022

Epoch 19/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0022

Epoch 20/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0024

Epoch 21/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0021

Epoch 22/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0021

Epoch 23/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0020

Epoch 24/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0019

Epoch 25/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0018

Epoch 26/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0020

Epoch 27/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0017

Epoch 28/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0017

Epoch 29/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 2ms/step - loss: 0.0017

Epoch 30/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0015

Epoch 31/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 32/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 33/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 34/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 35/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 36/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 37/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 38/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0012

Epoch 39/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 40/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0014

Epoch 41/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0012

Epoch 42/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0012

Epoch 43/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 44/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0011

Epoch 45/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0013

Epoch 46/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0011

Epoch 47/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0011

Epoch 48/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0011

Epoch 49/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 2ms/step - loss: 0.0010

Epoch 50/50

79/79 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step - loss: 0.0011

<keras.src.callbacks.history.History at 0x32cf73e20>

Note that the every epoch runs a little bit faster than in the LSTM model.

predicted_stock_price = regressor.predict(X_test)

predicted_stock_price = sc.inverse_transform(predicted_stock_price)

16/16 ━━━━━━━━━━━━━━━━━━━━ 0s 1ms/step

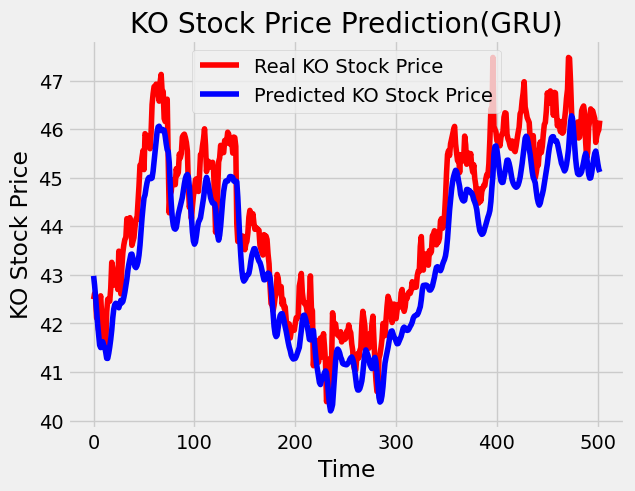

# Visualizing the results

plt.plot(test_set, color='red',label='Real KO Stock Price')

plt.plot(predicted_stock_price, color='blue',label='Predicted KO Stock Price')

plt.title('KO Stock Price Prediction(GRU)')

plt.xlabel('Time')

plt.ylabel('KO Stock Price')

plt.legend()

plt.show()

# Evaluating our model

rmse = math.sqrt(mean_squared_error(test_set, predicted_stock_price))

print("The root mean squared error is {}.".format(rmse))

The root mean squared error is 0.8338981916716676.

Interesting readings:

Understanding LSTM Networks. http://colah.github.io/posts/2015-08-Understanding-LSTMs/