05.01 - TIME SERIES PREDICTIONS#

!wget --no-cache -O init.py -q https://raw.githubusercontent.com/rramosp/ai4eng.v1/main/content/init.py

import init; init.init(force_download=False); init.get_weblink()

import numpy as np

import matplotlib.pyplot as plt

import pandas as pd

import local.lib.timeseries as ts

%matplotlib inline

The data#

d = pd.read_csv("local/data/eurcop.csv")

d.index = pd.to_datetime(d.Date)

del(d["Date"])

d.head()

| Rate | High (est) | Low (est) | |

|---|---|---|---|

| Date | |||

| 1999-09-06 | 2068.55 | 0.0 | 0.0 |

| 1999-09-07 | 2078.17 | 2103.0 | 2053.7 |

| 1999-09-08 | 2091.05 | 0.0 | 0.0 |

| 1999-09-09 | 2093.84 | 2118.6 | 2069.4 |

| 1999-09-10 | 2087.55 | 0.0 | 0.0 |

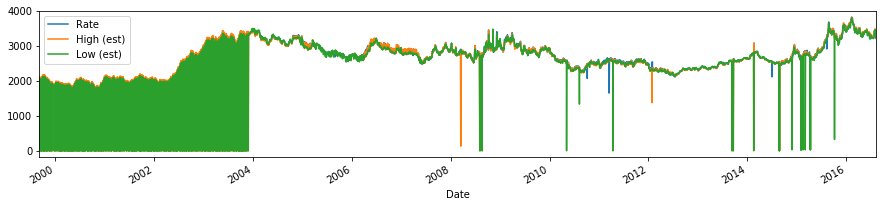

d.plot(figsize=(15,3))

<matplotlib.axes._subplots.AxesSubplot at 0x7fd05ad8cf50>

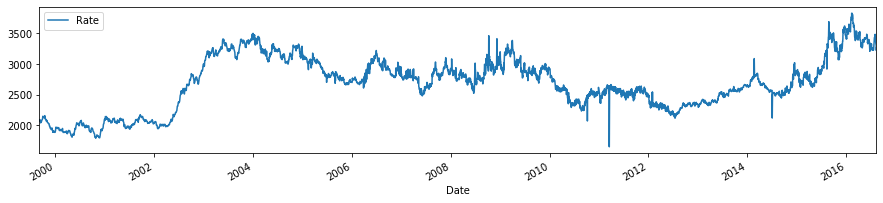

d[["Rate"]].plot(figsize=(15,3))

<matplotlib.axes._subplots.AxesSubplot at 0x7fd05853d290>

d = d[["Rate"]]

d.head(10)

| Rate | |

|---|---|

| Date | |

| 1999-09-06 | 2068.55 |

| 1999-09-07 | 2078.17 |

| 1999-09-08 | 2091.05 |

| 1999-09-09 | 2093.84 |

| 1999-09-10 | 2087.55 |

| 1999-09-13 | 2062.96 |

| 1999-09-14 | 2047.08 |

| 1999-09-15 | 2040.93 |

| 1999-09-16 | 2047.17 |

| 1999-09-17 | 2060.87 |

A predictive model#

First create a time series dataset with look back#

dt = ts.timeseries_as_many2one(d, columns=["Rate"], nb_timesteps_in=4, timelag=0)

dt.head()

| Rate_0 | Rate_1 | Rate_2 | Rate_3 | Rate | |

|---|---|---|---|---|---|

| Date | |||||

| 1999-09-10 | 2068.55 | 2078.17 | 2091.05 | 2093.84 | 2087.55 |

| 1999-09-13 | 2078.17 | 2091.05 | 2093.84 | 2087.55 | 2062.96 |

| 1999-09-14 | 2091.05 | 2093.84 | 2087.55 | 2062.96 | 2047.08 |

| 1999-09-15 | 2093.84 | 2087.55 | 2062.96 | 2047.08 | 2040.93 |

| 1999-09-16 | 2087.55 | 2062.96 | 2047.08 | 2040.93 | 2047.17 |

Split dataset for trian and for test#

trds = dt[:"2008"]

tsds = dt["2009":]

print (dt.shape, trds.shape, tsds.shape)

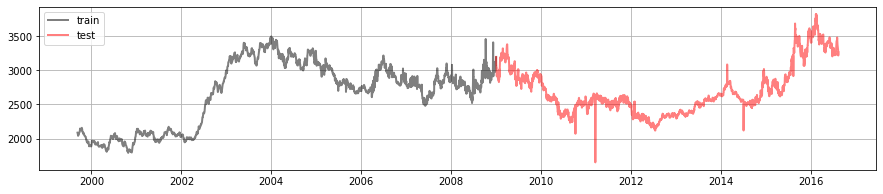

plt.figure(figsize=(15,3))

plt.plot(trds.index.values, trds.Rate.values, color="black", lw=2, label="train", alpha=.5)

plt.plot(tsds.index.values, tsds.Rate.values, color="red", lw=2, label="test", alpha=.5)

plt.grid();

plt.legend();

(5040, 5) (2691, 5) (2349, 5)

Create X and y matrices for train and test#

Xtr, ytr = trds[[i for i in trds.columns if i!="Rate"]].values, trds.Rate.values

Xts, yts = tsds[[i for i in tsds.columns if i!="Rate"]].values, tsds.Rate.values

trds[:5]

| Rate_0 | Rate_1 | Rate_2 | Rate_3 | Rate | |

|---|---|---|---|---|---|

| Date | |||||

| 1999-09-10 | 2068.55 | 2078.17 | 2091.05 | 2093.84 | 2087.55 |

| 1999-09-13 | 2078.17 | 2091.05 | 2093.84 | 2087.55 | 2062.96 |

| 1999-09-14 | 2091.05 | 2093.84 | 2087.55 | 2062.96 | 2047.08 |

| 1999-09-15 | 2093.84 | 2087.55 | 2062.96 | 2047.08 | 2040.93 |

| 1999-09-16 | 2087.55 | 2062.96 | 2047.08 | 2040.93 | 2047.17 |

print (Xtr[:10])

print (ytr[:10])

[[2068.55 2078.17 2091.05 2093.84]

[2078.17 2091.05 2093.84 2087.55]

[2091.05 2093.84 2087.55 2062.96]

[2093.84 2087.55 2062.96 2047.08]

[2087.55 2062.96 2047.08 2040.93]

[2062.96 2047.08 2040.93 2047.17]

[2047.08 2040.93 2047.17 2060.87]

[2040.93 2047.17 2060.87 2065.02]

[2047.17 2060.87 2065.02 2061.61]

[2060.87 2065.02 2061.61 2080.33]]

[2087.55 2062.96 2047.08 2040.93 2047.17 2060.87 2065.02 2061.61 2080.33

2085.85]

tsds[:5]

| Rate_0 | Rate_1 | Rate_2 | Rate_3 | Rate | |

|---|---|---|---|---|---|

| Date | |||||

| 2009-01-01 | 3079.180176 | 3079.180176 | 3140.934326 | 3193.720215 | 3197.497070 |

| 2009-01-02 | 3079.180176 | 3140.934326 | 3193.720215 | 3197.497070 | 3093.394775 |

| 2009-01-04 | 3140.934326 | 3193.720215 | 3197.497070 | 3093.394775 | 3029.256836 |

| 2009-01-05 | 3193.720215 | 3197.497070 | 3093.394775 | 3029.256836 | 3029.256836 |

| 2009-01-06 | 3197.497070 | 3093.394775 | 3029.256836 | 3029.256836 | 2914.927246 |

print (Xts[:10])

print (yts[:20])

[[3079.18017578 3079.18017578 3140.93432617 3193.72021484]

[3079.18017578 3140.93432617 3193.72021484 3197.49707031]

[3140.93432617 3193.72021484 3197.49707031 3093.39477539]

[3193.72021484 3197.49707031 3093.39477539 3029.25683594]

[3197.49707031 3093.39477539 3029.25683594 3029.25683594]

[3093.39477539 3029.25683594 3029.25683594 2914.92724609]

[3029.25683594 3029.25683594 2914.92724609 2969.78344727]

[3029.25683594 2914.92724609 2969.78344727 2954.19067383]

[2914.92724609 2969.78344727 2954.19067383 2983.23510742]

[2969.78344727 2954.19067383 2983.23510742 2923.44677734]]

[3197.49707031 3093.39477539 3029.25683594 3029.25683594 2914.92724609

2969.78344727 2954.19067383 2983.23510742 2923.44677734 2923.44677734

2913.42114258 2897.17138672 2885.69604492 2940.19921875 2941.0378418

2941.0378418 2878.10864258 2848.63378906 2873.06689453 2828.56445312]

convert target into classification task for TREND PREDICTION (1 up, 0 down)#

yts = (yts>Xts[:,-1]).astype(int)

ytr = (ytr>Xtr[:,-1]).astype(int)

print (ytr[:20])

print (yts[:20])

[0 0 0 0 1 1 1 0 1 1 1 1 1 1 1 1 0 0 1 0]

[1 0 0 0 0 1 0 1 0 0 0 0 0 1 1 0 0 0 1 0]

inspect target class distributions#

print ("1's in train %.2f%s"%(np.mean(ytr)*100, "%"))

print ("1's in test %.2f%s"%(np.mean(yts)*100, "%"))

1's in train 45.04%

1's in test 41.72%

train a predictive model#

from sklearn.ensemble import RandomForestClassifier

from sklearn.svm import SVC

from sklearn.naive_bayes import GaussianNB

from sklearn.tree import DecisionTreeClassifier

from sklearn.linear_model import LogisticRegression

from sklearn.decomposition import PCA

from sklearn.pipeline import Pipeline

estimator = RandomForestClassifier(n_estimators=5, max_depth=30)

#estimator = DecisionTreeClassifier(max_depth=2)

#estimator = LogisticRegression()

#estimator = Pipeline((("pca", PCA(n_components=2)), ("estimator", estimator)))

estimator.fit(Xtr,ytr);

get predictive accuracy in train and test#

print ("train accuracy %.2f"%estimator.score(Xtr,ytr))

print ("test accuracy %.2f"%estimator.score(Xts,yts))

train accuracy 0.92

test accuracy 0.52

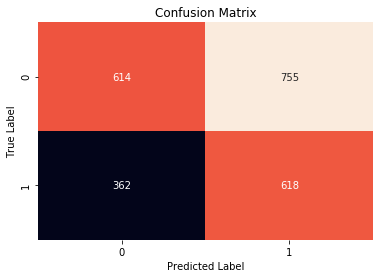

inspect confusion matrix#

from sklearn.metrics import confusion_matrix

import seaborn as sns

cm = confusion_matrix(yts, estimator.predict(Xts))

sns.heatmap(cm,annot=True,cbar=False, fmt="d")

plt.ylabel('True Label')

plt.xlabel('Predicted Label')

plt.title('Confusion Matrix')

Text(0.5, 1, 'Confusion Matrix')

A strategy#

if model predicts 1 (price up) we buy 10 EUR today and sell them tomorrow

if model predicts 0 (price down) we sell 10 EUR today and buy them tomorrow

def trade(d, date_close, op, qty):

assert op in ["buy", "sell"]

assert qty>=0

r = (d.loc[:date_close].iloc[-2].Rate-d.loc[date_close].Rate)*qty

if op=="buy":

r = -r

return r

example: a buy operation on 2011-01-03 closed (with a sell operation) on 2011-01-04

trade(tsds, "2011-01-04", "buy", 100)

701.0498039999675

trade(tsds, "2011-01-05", "buy", 100)

-77.17285099997753

tsds["2011-01-02":].iloc[:5]

| Rate_0 | Rate_1 | Rate_2 | Rate_3 | Rate | |

|---|---|---|---|---|---|

| Date | |||||

| 2011-01-02 | 2528.971680 | 2528.971680 | 2618.146240 | 2567.137939 | 2520.103760 |

| 2011-01-03 | 2528.971680 | 2618.146240 | 2567.137939 | 2520.103760 | 2520.103760 |

| 2011-01-04 | 2618.146240 | 2567.137939 | 2520.103760 | 2520.103760 | 2527.114258 |

| 2011-01-05 | 2567.137939 | 2520.103760 | 2520.103760 | 2527.114258 | 2526.342529 |

| 2011-01-06 | 2520.103760 | 2520.103760 | 2527.114258 | 2526.342529 | 2478.751709 |

yts

array([1, 0, 0, ..., 0, 0, 1])

def compute_pnl(d, y, predictions, qty=10):

pnl = []

for date,prediction in zip(d.index[1:], predictions[1:]):

pnl.append(trade(d, date, "sell" if prediction==0 else "buy", qty))

pnl = pd.DataFrame(np.r_[[pnl]].T, index=d.index[1:], columns=["pnl"])

pnl["prediction"]=predictions[1:]

pnl["y"]=y[1:]

return pnl

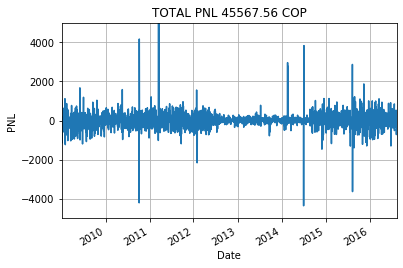

preds = estimator.predict(Xts)

pnl = compute_pnl(tsds, yts, preds)

pnl.pnl.plot()

plt.title("TOTAL PNL %.2f COP"%pnl.pnl.sum())

plt.ylabel("PNL")

plt.grid();

plt.ylim(-5000,5000);

def plot_pnlhist(pnl_series, label=""):

k = pnl_series.values

total = np.sum(k);

k = k[np.abs(k)<50000]

plt.hist(k, bins=30);

plt.title("PNL for %s, total %.2f COP"%(label, total))

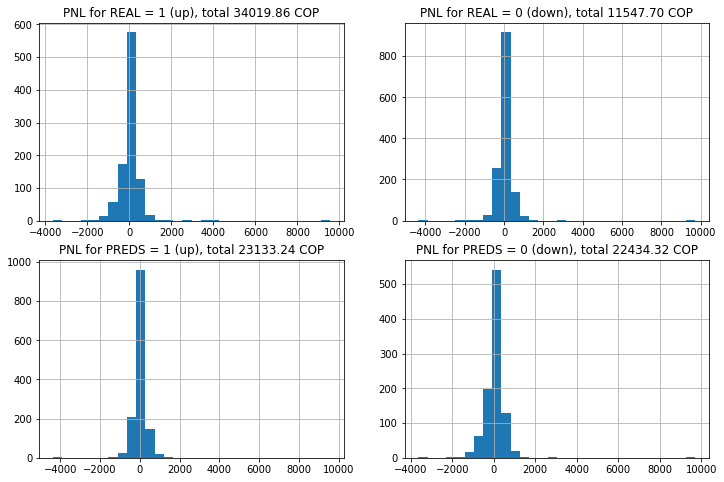

plt.figure(figsize=(12,8))

plt.subplot(221); plot_pnlhist(pnl[pnl.y==1].pnl, "REAL = 1 (up)"); plt.grid();

plt.subplot(222); plot_pnlhist(pnl[pnl.y==0].pnl, "REAL = 0 (down)"); plt.grid();

plt.subplot(223); plot_pnlhist(pnl[preds[1:]==1].pnl, "PREDS = 1 (up)"); plt.grid();

plt.subplot(224); plot_pnlhist(pnl[preds[1:]==0].pnl, "PREDS = 0 (down)"); plt.grid();